Basel 3 is the new regulation of capital requirements of a bank. These new regulations are issued by Basel committee on banking supervision in 2010. These regulations and recommendations are the the amendment of Basel 2 recommendations.Basel 3's recommendations will improve the banking system by increasing the efficiency to cover the shock of financial crisis. Basel 3 will also reduce the financial risk.

Before recommending Basel 3 in 2010, Basel committee studied the reasons of international world crisis in 2008. By adopting recommendations of this Basel 3, risk of happening same financial crisis will decrease.

Every commercial bank which is working in India should have capital as per following % of risk weighted assets.

1. Minimum common equity tier 1 ratio for credit risk + market risk + operational risk

India 5.5 and BCBS recommended 4.5

2. Capital conservation buffer

India 2.5 and BCBS recommended 2.5

3. Minimum common equity tier 1 ratio + capital conservation buffer ( 1+2)

India 8 and BCBS recommended 7

4. Additional Tier 1 capital

India 1.5 and BCBS recommended 1.5

5. Minimum Tier 1 capital ratio

(1+4)

India 7 and BCBS recommended 6

6. Tier 2 Capital

India 2 and BCBS recommended 2

7. Minimum total capital ratio ( 5 + 6)

India 9 and BCBS recommended 8

8. Minimum total cpaital ratio + capital conservation buffer ( 7 +2)

India 11.5 and BCBS recommended 10.5

These recommendations will apply on scheduled commercial banks excluding RRBs and LABs.

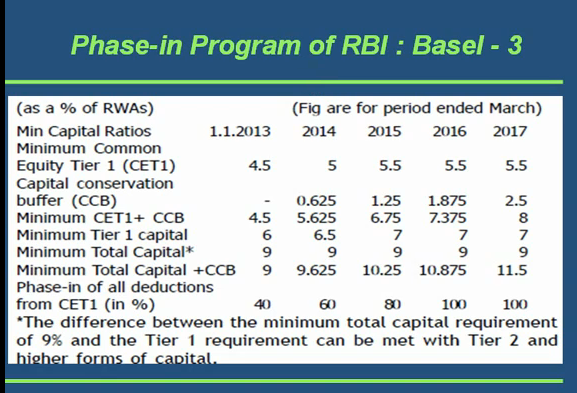

Now, question is, whether above recommendations will apply in 2012 or in future. Actually, these recommendations are phase-in- programme of RBI. Following is the chart which will show you the period in which 100% of these recommendations will apply.

Before recommending Basel 3 in 2010, Basel committee studied the reasons of international world crisis in 2008. By adopting recommendations of this Basel 3, risk of happening same financial crisis will decrease.

Regulatory Capital under Basel 3

1. Tier 1 capital

a) Common equity tier 1 and additional tier 1 capital2. Tier 2 capital

3. Capital conservation buffer ( CCB)

Overall capital as a % to risk weighted assets.Every commercial bank which is working in India should have capital as per following % of risk weighted assets.

1. Minimum common equity tier 1 ratio for credit risk + market risk + operational risk

India 5.5 and BCBS recommended 4.5

2. Capital conservation buffer

India 2.5 and BCBS recommended 2.5

3. Minimum common equity tier 1 ratio + capital conservation buffer ( 1+2)

India 8 and BCBS recommended 7

4. Additional Tier 1 capital

India 1.5 and BCBS recommended 1.5

5. Minimum Tier 1 capital ratio

(1+4)

India 7 and BCBS recommended 6

6. Tier 2 Capital

India 2 and BCBS recommended 2

7. Minimum total capital ratio ( 5 + 6)

India 9 and BCBS recommended 8

8. Minimum total cpaital ratio + capital conservation buffer ( 7 +2)

India 11.5 and BCBS recommended 10.5

These recommendations will apply on scheduled commercial banks excluding RRBs and LABs.

Now, question is, whether above recommendations will apply in 2012 or in future. Actually, these recommendations are phase-in- programme of RBI. Following is the chart which will show you the period in which 100% of these recommendations will apply.

Related : Basel Accords